ASO Competitive Research & Analysis: a Step-by-Step Guide

Gabriel Kuriata

Gabriel Kuriata  Gabriel Kuriata

Gabriel Kuriata ASO competitive research is the process of evaluation of apps with similar functionality or features and overlapping user acquisition channels. Its purpose is to identify opportunities for growth and areas for optimization.

In a way, ASO competitive research is like reverse engineering your competitors’ apps, disassembling them to see what elements might have contributed to their success.

ASO competitor analysis will be crucial for your app’s growth. With more than 30 thousand mobile apps published every month on the App Store it’s easy to see your app won’t function in a vacuum. In order to break through, your app will have to find its place among many other apps fighting for users’ limited attention with varying marketing strategies.

Whether you use the knowledge acquired during the ASO competitor analysis to emulate the top performers or find your own way to draw attention in a crowded category is up to you. But if you base your decisions and ASO strategy on data competitor analysis provides and not just intuition, you’re much more likely to succeed.

Our goals are pretty straightforward:

We recommend to perform competitor analysis on two levels:

To accomplish aforementioned goals on both levels, we’ll be conducting these tasks:

Creative assets evaluation is in fact the most important part of our ASO competitor analysis. It has the largest scope and yields the most useful information. It can be incredibly fun, but at the same time frustratingly difficult.

Why? To answer this question at this point, we highly recommend you have to take a look at our “Lifestyle Apps: ASO and UA trends” report:

What makes a picture great? What makes an icon work? Our “Lifestyle Apps: ASO and UA trends” benchmark report may be a useful read for publishers of all apps, as it contains an analysis of 200 top performing apps from the Lifestyle category and a multitude of visual examples of creative assets evaluation – with insights and recommendations by our SplitMetrics’ experts. Even if your app is from a different category, this report will give you an important insight into elements of design that matter and showcase interesting logic behind their creation.

It might also be a great idea to read our “ASO Benchmarks & Mobile Trends” report for 2022:

What conversion rate should your app have? What product page elements matter most for potential users? Needs and search habits of users looking for financial apps or games are far apart. This is why any optimization efforts must take category benchmarks into consideration. Before you make your product page optimized, you have to understand what optimized truly means for apps that resemble yours the most. “ASO Benchmarks & Mobile Trends 2022” explains just that.

Also, as you might have already guessed, we’ll be looking at images (icons, screenshots) and so on and trying to deduce which ones of them led to a higher tap-through rate or a conversion rate – and why. As we mentioned, dissecting your competitors can be fun…but ultimately the end result of ASO competitive analysis are hypotheses (ideas to modify your app’s product page), not hard, accurate data.

One final note before we get down to business. This article focuses on the app store optimization process for the Apple App Store. A competitor analysis for Google Play would be very similar, but should be conducted separately for all app stores.

We know our goals and scope, so let’s get down to business.

What apps are REALLY your competitors? The answer to that isn’t as simple as it seems. Watch out, because there’s some pitfalls here to avoid:

Again, this is why it’s so important to…

Even detailed information about your competitors will be meaningless without any reference. Proper benchmarks are crucial, because they will help you evaluate your own efforts. We recommend two essential reads at this point:

One will provide you with insights crucial for picking the right benchmarks later. The first one will help you take meaningful action right after our next step which is to…

Keyword research is probably the most time consuming element of establishing our presence on the App Store. It’s a foundation of our Apple Search Ads campaigns, product page copy as well as its metadata. It’s so important, that it’s covered in two lessons in our advanced Apple Search Ads Course (lessons 4 & 5):

Learn all you need to know about keyword research in the complete SplitMetrics Acquire Apple Search Ads Course.

To cut to the point: first, we’ll use the keyword planner available in our Apple Search Ads optimization platform SplitMetrics Acquire to create a list of all the keywords that our competitors rank for:

The process is simple and automated. After selecting a number of key competitors and compiling a list of new keywords, we can examine each one of them individually, add more competitors, more keywords… and so on. There’s a wide range of tools for this task available, like App Radar, AppTweak or AppFollow to name just a few. Use the one you like most, because ultimately they’ll all lead you to….

The result: you should now have a comprehensive list of keywords and relevant competitors that should give you an idea of how communication is shaped in your competitive environment and what keywords to rank for.

Next steps are technically simple. The best case scenario is that you find popular, relevant keywords that you have a chance of ranking high. Naturally, this is easier said than done. At this stage we can offer you this advice: there’s no point in wasting your precious keywords space on your product page (or your title, subtitle) for poor keywords. Aim high… and introduce changes when you don’t succeed. Implement, test, optimize. Rinse and repeat.

Most searches on the App Store are brand-centric, reflecting the intent of users to find specific apps through the Search function. For the purpose of the ASO competitive analysis, you need to take a closer look at unbranded, keywords, in order to be seen by users looking for specific features or functionality.

Given that the task of optimizing keywords on your app’s product page is a big subject on it’s own, perhaps in this article it would be best to direct you to a more comprehensive guide on product page keyword optimization, as ultimately competitor research is an integral part of it:

Now it’s time to look for benchmarks: most successful apps relevant for us, that can help us take an in-depth look at our own product page and optimize.

We should have a competitor list and clear understanding on who to pick up for this stage of analysis. Choose top 10 apps that might be worth looking into on a deeper level.

The number of downloads (or the number of instances a user taps that “GET” button to be exact) is the ultimate measure of success on the App Store. Top results in Search capture the majority of taps, just like top 10 positions in any list.

So, if someone is in the top 10 most downloaded apps in a category or in organic results – they’re doing something right.

It’s not enough to look at just the numbers though. Most downloaded apps may be well their prime time in their lifecycle and they may be losing ground to newcomers. Besides the physical number of downloads – dynamics and growth are also important factors.

Even a quick glance at our aforementioned “Benchmarks” report shows that KPI that reflect the overall condition of a given category can change dramatically even in a relatively short period of time.

Reviews are important, and lower scores can have a tremendous impact on the conversion rate of an app’s product page. Jumping from average 3-stars to 4-start can result in 89% conversion uplift. Don’t hesitate to follow the vox populi and focus your qualitative analysis on apps with high ratings.

Although technically, from the viewpoint of your ASO efforts downloads are more important (after all, it’s the visibility and conversion rate that are our goal), bad reviews and low scores should be red flags. Relevance score is important. Negative reviews may signal that the app somehow fails expectations set by its creative assets, copy and campaigns and taking it as a reference point for our efforts may result in misdirected findings.

At the same time, don’t become frustrated when you notice your competitors have ratings and reviews higher than your app. This can be helped, but it will need time. You can start now by replying to all of them, especially negative ones. Fortunately, there are tools like Asodesk to help you do that.

At this point, we should have about 10 competitors to dissect. Those relevant to you, popular, growing and with good reviews.

Title and short description contribute to organic visibility on the App Store and have a significant impact on the app’s tap-through rate and product page conversion rate. Long description matters too… at least till the “read more” part ;).

Okay, so what are we looking for now?. After spending some time with SplitMetrics Acquire’s keyword planner described above, you should have the keyword field optimized. This means that your app’s meta keywords – those are visible only in the source of a product page (or any ASO tool you might be using, like AppTweak) – should be selected.

This time, we’re looking at our direct competitors individually, because they may be an indicator of a given app’s reliance on their brand to drive traffic. You might want to reconsider brand-reliant and non-optimized competitors as benchmarks.

What else? Look at how keywords are used to describe key features. Try to get an idea of what the focus is. Look at how keywords are put to work in delivering something meaningful.

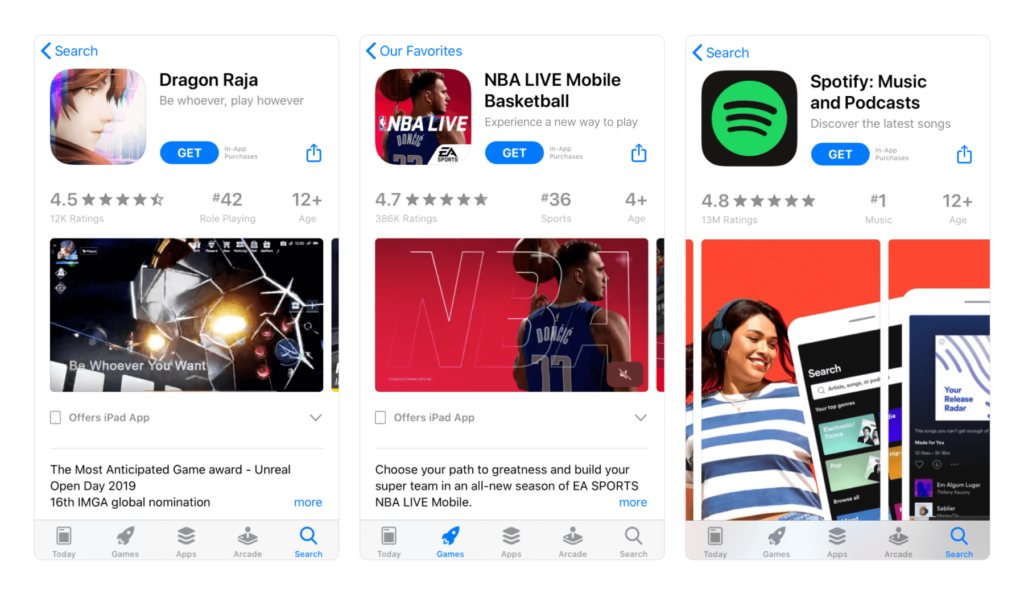

App Store product page visuals are crucial for its conversion rate. Changes to them can result in significant conversion uplift, but what works best is heavily dependent on an app’s category and subcategory. A user looking for a game may focus on entirely different aspects of an image than the one searching for a finance app. This is why we evaluate ourselves and our benchmarks in reference to them.

Evaluating a competitor’s creative assets may seem trivial but it’s far from it. You’re looking at hundreds of little elements simultaneously and it’s difficult to pinpoint elements that may have contributed significantly to the product pages high conversion rate. Take this example:

Characters and people facing right – looking at the app’s title or graphics. Believe it or not, this change had a noticeable effect on the Tap-through Rate of this app.

This is why looking at a category & subcategories as a whole is so important. You can ask yourself how a given app stands out from the crowd. What design elements are consistently present. Also, general knowledge and familiarity with such elements help you draw attention to things that might actually work.

The result of this step? You should arrive with a multitude of ideas that you can implement on your app’s product page.

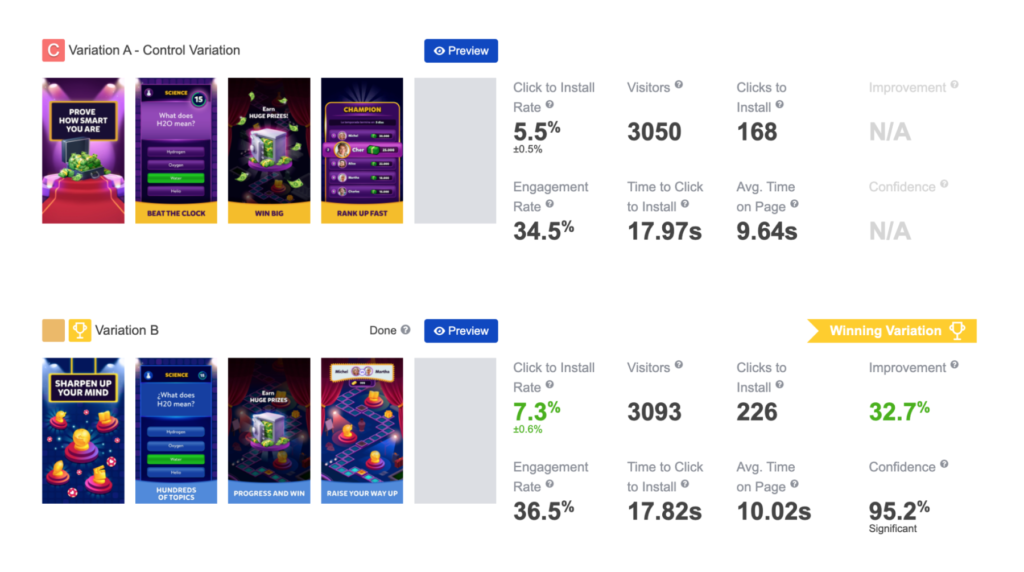

What should be your next steps? Again, you can try to make an educated guess or take a more data oriented approach and plan a series of tests (with our tool SplitMetrics Optimize) to be sure what works and what doesn’t. Ultimately, this may save you a lot of work and money in the long run.

It’s possible that truly conclusive data will be yielded only in the process of A/B testing. Your competitive keyword research may require some restructuring as well.

Formulating a good ASO strategy and the process of app store optimization is challenging. It is something that directly reflects publishers’ response to frequently not entirely understood user expectations. An icon, screenshots, video, description may not seem like much, but the number of elements on them can can and will work may surprise even the most seasoned ASO specialists. This is why to keep your finger on the pulse of benchmarks and case studies and carefully plan any changes (again, this is something that’s much easier done with an A/B testing tool, which ultimately forces you to maintain an order of doing things).

To wrap things up, we encourage you to read our reports that give practical insight into app categories and subcategories:

Hopefully, these will give all mobile marketers enough valuable insights and insider knowledge to make informed decisions in formulating their ASO strategy and marketing strategy on all app stores.